Why bother with a mortgage when you have billions of dollars? Why even fill out a loan application for that matter when you can simply pay cash for any home on the market?

Well, that’s probably why Jay-Z and Beyoncé’s decision to take on not one but two mortgages on their $88 million Bel Air mansion has raised some eyebrows.

Property records examined by The Daily Mail suggest that the couple, who are worth roughly $3.3 billion together, secured a $57.75 million mortgage on the property this April. That’s in addition to the previous $52.8 million mortgage secured four years ago.

Are the music moguls struggling financially and broke billionaires, as some online commentators have speculated, or is this a savvy real estate move? Here’s a closer look.

I’ve got 99 problems, but a mortgage ain’t one

An outstanding liability of roughly $110.55 million on a single property sounds mind-boggling until you put it into context. Not only is the figure just 3.4% of the couple’s combined wealth, it’s also at a fairly attractive interest rate.

According to The Daily Mail, the new mortgage has been secured from Morgan Stanley’s Private Bank Group at a 30-year term with an interest rate fixed at 5% for the next ten years. The previous mortgage, meanwhile, was secured from Goldman Sachs at 3.15%. Effectively, the average rate on both these mortgages is significantly below the August 2025 30-year mortgage rate of 6.6%, according to the Federal Reserve.

Even if the interest rates were closer to the average, these loans would have still unlocked some key financial benefits for the billionaire couple.

Buy, borrow, die

By borrowing money against an asset they can easily afford, Jay-Z and Beyoncé seem to be pulling from the “Buy, Borrow, Die” playbook. The strategy involves acquiring appreciating assets, such as real estate, stocks or artwork. Then they borrow against those assets to create tax-free cash flow, subsequently passing the assets to their heirs (Blue Ivy, Rumi and Sir) to erase capital gains over the long term.

Beyond the tax advantages, this method also helps wealthy families minimize opportunity costs. By borrowing against their Bel Air mansion, Jay-Z and Beyoncé can invest roughly $110 million in their various business ventures or even the S&P 500, which has delivered a compounded annual growth rate of 13.66% over the past ten years.

On their passing, the property portfolio’s tax basis would reset, potentially saving the three children millions of dollars in capital gains taxes.

Jay-Z and Beyoncé are not the only ones using this clever strategy. Back in 2012, Meta’s CEO Mark Zuckerberg refinanced his Palo Alto home at a 30-year fixed term with an adjustable rate of 1.05% despite being the 40th richest person in the world at the time.

The good news is that you don’t have to be a billionaire to use leverage as a financial tool.

Can’t knock the hustle

Anyone, regardless of their net worth, can use debt in strategic ways to start building wealth.

The most important part of this strategy is to borrow only for appreciating assets. So, a mortgage to buy property or a business loan to start a new venture should help you build equity, while an expensive personal loan or credit card debt to finance vacations could destroy wealth over time.

While borrowing money, shop around for the best rate and try to negotiate before signing up. Every basis point you can cut from the loan agreement can magnify your savings over the long term.

You may also want a hard cap on how much you can borrow, regardless of how low the interest rate is or how attractive the underlying asset seems. Zuckerberg, Jay-Z and Beyoncé have mortgages that are a small fraction of their overall net worth. Similarly, financial advisors suggest keeping your debt-to-income ratio below 41% to avoid risk.

Finally, consult a financial advisor to understand all the tax benefits your loan could offer. For example, couples filing together can deduct mortgage interest payments from their taxable income for payments on the first $750,000 of mortgage debt.

By strategically planning and applying debt in this way, you could supercharge your wealth creation journey.

News

WORRYING!!! Tommy Fleetwood is currently in Dubai, one of the hotspots in the Middle East where tensions are escalating.

Tommy Fleetwood and wife 23 years his senior quit UK for Dubai with heartwarming reason Ryder Cup hero Tommy Fleetwood…

EXCLUSIVE!!! Tiger Woods feels suffocated and uncomfortable being “monitored” by Vanessa Trump.

Tiger Woods Feels ‘Henpecked’ While Navigating ‘Trust’ Issues With ‘Insecure’ Vanessa Trump Chip Somodevilla/UPI/Newscom/The Mega Agency; HUGO PHILPOTT/UPI/Newscom/The Mega Agency…

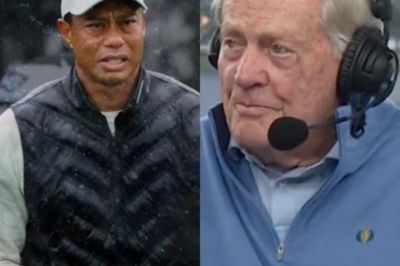

Golf legend Jack Nicklaus continues to deliver a blunt and bitter remark to golf fans and even Tiger Woods, comparing their successes at the PGA Championship.

Jack Nicklaus offers blunt verdict on Tiger Woods breaking major record Golf icon Jack Nicklaus reignited the debate over his…

The US confirms the loss of three F-15 aircraft due to an ‘friendly fire’ incident.

The US Central Command confirmed on March 2nd that three US F-15E Strike Eagle aircraft crashed in Kuwaiti airspace due…

Shocking: Jelly Roll narrowly escaped death after an ATV accident left him with a broken collarbone.

Jelly Roll Reveals He Broke His Collarbone In ATV Accident, Admits He Hid Injury And Quietly Recovered For Months “I…

Kelly Osbourne condemned the ‘cruelty’ of body shaming after she and her mother walked the red carpet at the Brit Awards.

Kelly Osbourne condemned the ‘cruelty’ of body shaming after she and her mother walked the red carpet at the Brit…

End of content

No more pages to load