The world’s richest billionaire Elon Musk, who owns more than $1 billion in Bitcoin through his electric car company Tesla, once again warned that the United States is rapidly heading towards bankruptcy, right at the time when US Treasury Secretary Scott Bessent suddenly spoke out in support of Bitcoin.

Elon Musk warns America is heading towards bankruptcy

Billionaire Musk was the man who helped US President Donald Trump return to the White House last year thanks to his dire warnings about the imminent risk of a financial crisis.

Now, as investors prepare for the Federal Reserve’s biggest policy shift yet, Musk warned that the debt crisis cannot be solved without “breakthrough” economic growth, which many Bitcoin advocates believe will send the price of the digital currency soaring.

The world’s richest billionaire Elon Musk has once again warned that America is rapidly heading towards bankruptcy.

The world’s richest billionaire Elon Musk has once again warned that America is rapidly heading towards bankruptcy.

“To be fair, even if you could implement incredibly draconian policies to cut waste and fraud, there’s still no way to solve this debt crisis,” billionaire Musk said on Joe Rogan’s podcast.

The US public debt has soared in recent years, following a period of heavy government spending during the Covid-19 pandemic and lockdowns, while rising interest rates to curb inflation have made the cost of servicing the debt even higher. The total debt now stands at $38 trillion.

“The interest on the national debt is now larger than the defense budget and it’s still growing. It’s insane,” Musk told Rogan during a three-hour conversation.

Mr. Musk, who served in the Trump administration as part of the “Department of Government Efficiency (DOGE), clashed with President Trump earlier this year over the president’s signature tax and spending bill, which is expected to add trillions of dollars to the U.S. national debt over the next decade.

Billionaire Musk later confirmed that the new party he founded, called the America Party, would adopt Bitcoin as part of its financial policy, calling the US dollar and other non-asset-backed fiat currencies “hopeless”.

However, Mr. Musk seems to have given up hope of saving America from the risk of “bankruptcy” by simply cutting spending.

“Even if you do all the savings, it only delays the day of reckoning, when America actually goes bankrupt. I’ve come to the conclusion that the only way to get us out of this debt crisis and prevent America from collapsing is through AI and robotics. We need economic growth that is strong enough to pay off the debt,” Musk said.

The US national debt hit $38 trillion last month, increasing by $500 billion in October alone, according to The Kobeissi Letter.

“The higher the national debt, the higher the price of Bitcoin”

“This is a very bad situation, there is nothing good about it,” said Anthony Pompliano, an investor and influencer in the cryptocurrency space, and CEO of Professional Capital Management.

“The only thing I can do is take some of the value out of this failing system. The higher the national debt, the higher the price of Bitcoin, and it seems like neither is stopping,” said Mr. Pompliano.

Bitcoin prices have skyrocketed over the past few years, rising in tandem with the skyrocketing US debt levels.

Bitcoin prices have skyrocketed over the past few years, rising in tandem with the skyrocketing US debt levels.

Bitcoin prices have soared in recent years in tandem with the ballooning US debt, a rally traders call along with gold a “currency hedge.”

“In the long term, the investment opportunity in Bitcoin and other risk assets remains valuable,” said Nic Puckrin, investment analyst and co-founder of The Coin Bureau.

Bitcoin prices peaked at $126,000 per coin in early October but then fell back as traders turned to gold and stocks, as the Fed prepared to cut interest rates further and loosen monetary policy.

“We are witnessing a global trend of monetary easing, not just in the US, so some fiat currency depreciation is inevitable. However, in the short term, volatility still prevails. Any trader considering using high leverage in this market should think carefully before acting,” Mr. Puckrin added.

News

More bad news for Tiger Woods: Farewell to tradition with his son Charlie

Medical experts warn the golf legend’s latest back surgery makes a December return unlikely Tiger Woods (right) with his son…

Son recreates Justin Bieber’s teenage image, causing a storm on social networks

Son recreates Justin Bieber’s teenage image Justin Bieber’s baby boy’s transformation into his famous father has become a hit on…

Louis Tomlinson won’t sing some One Direction songs on tour for a special reason

Louis Tomlinson explains why he won’t sing certain One Direction songs on tour Louis Tomlinson performs One Direction songs on…

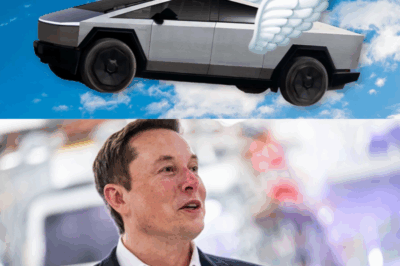

Elon Musk “caused a storm” again when he promised to release a “flying car” demo before the end of this year.

Elon Musk recently announced on his podcast about a “flying car” version by the end of 2025. In his latest…

Elon Musk “teases” OpenAI CEO about Tesla Roadster refund after 7.5 years of waiting

Elon Musk and Sam Altman continue to spar on Musk’s social media platforms, after Altman shared a story about ordering…

Tiger Woods’ ex-girlfriend is getting married for the third time

Tiger Woods’ Ex Celebrates Big Day Ahead of Wedding No. 3 (Photo Credit: Jason LaVeris/FilmMagic via Getty Images) Rachel Uchitel is…

End of content

No more pages to load