Tesla’s craze after the 2024 US presidential election gamble is gradually deflating amid poor sales reports.

Recently, the fact that Tesla’s electric vehicle market share in Germany fell from 23% in January 2023 to 3.7% in the same period in 2025, equivalent to a decrease of 84%, has surprised many experts. It should be noted that Germany is an extremely friendly market for electric vehicles due to increasingly expensive gasoline prices here.

Even in the Chinese market, Tesla’s sales also fell by 11.5% because they were surpassed by BYD.

In fact, Tesla’s sales are falling on all international fronts, and profits are getting thinner due to the price reduction policy to compete. Worse still, the US’s termination of support programs could cause Tesla to lose billions of dollars in sales.

Fortune newspaper commented that Elon Musk’s engrossed in reforming the US government through the Department of Government Efficiency (DOGE) is making Tesla’s business situation worse.

Investors once hoped that a gamble with US President Donald Trump would help Elon Musk revive Tesla, but instead of solving the electric vehicle industry’s difficulties, the billionaire was distracted by other unrelated issues.

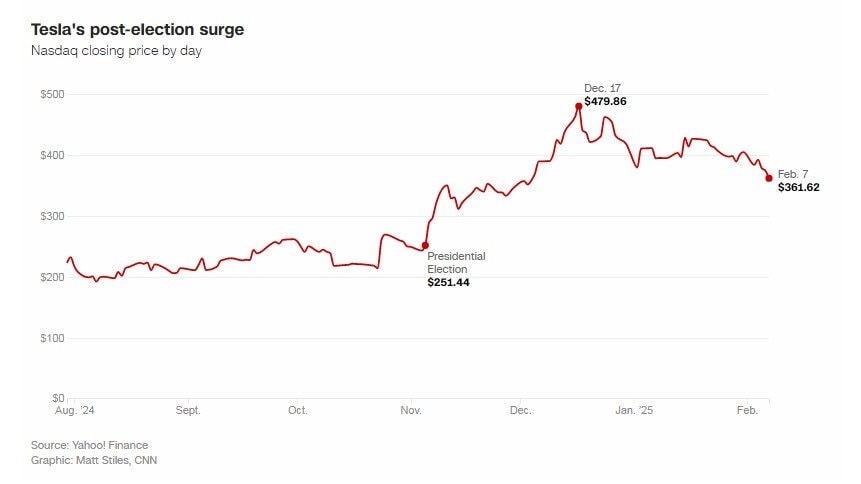

Tesla’s stock price (USD) has been falling steadily since the post-election boom

Even these political factors are affecting Tesla’s sales.

The loser?

“Tesla was the biggest loser in terms of electric vehicle market share in Germany in January 2025 despite the overall market growth,” the UBS report stated.

Tesla’s sales in Germany fell by 60% while the overall electric vehicle market grew by 53%.

There is currently no data from the US market because Tesla does not use third-party dealers to sell its cars, so its quarterly report is the only data available.

Behind the reason for the increasing number of competing electric vehicle brands, according to Fortune, is the past of “so many broken promises” and Elon Musk’s neglect that is causing investors to gradually lose confidence.

Previously, Tesla CEO Elon Musk promoted the electric car company as a technology startup to seek funding. However, after acquiring Twitter-X and entering the political world, the world’s richest billionaire no longer pays attention to Tesla as he had promised.

Although Tesla’s stock price is still far ahead of any other automaker, the growth has slowed down, the post-2024 US presidential election fever has gradually passed as business reports have been gloomy.

It should be noted that in the most recent business results report, Elon Musk promised self-driving electric cars, robot taxis, and a “grand” 2025.

However, all investors have seen since the beginning of 2025 is the story of Elon Musk reforming the US government, arguing with officials, and following President Donald Trump.

CEO Elon Musk has always been distracted by his other businesses, like SpaceX, The Boring Company, Neuralink, and his social media platform X, and is now even more distracted by his role in reshaping the federal government.

Even with the electric vehicle tax credit still in effect, Tesla is expected to report its first annual sales decline in 2024 as it faces increased competition from other automakers.

So removing the tax subsidy from the US government would make Teslas even more expensive than gasoline cars.

That’s not to mention the billions of dollars in carbon credits sold to rivals that make gasoline cars that are at risk of being wiped out as the Trump administration considers rolling back such stringent emissions regulations.

Tesla is also about to lose its title as the world’s largest electric vehicle maker to China’s BYD.

Even Tesla’s sales could be affected by political factors.

At this point, investors are starting to remember Elon Musk’s history of breaking promises and are questioning the connection between the company’s stock price rise and its performance.

“Tesla’s stock price rise has nothing to do with the company’s financial performance in the quarter just ended or its growth outlook for the year ahead. Tesla’s stock growth has become completely detached from the fundamentals of the stock market,” said JPMorgan analyst Ryan Brinkman.

Despite that, Elon Musk has repeatedly pledged that Tesla’s total market capitalization will one day be larger than the top five companies in the market combined. The CEO has also pledged to generate $10 trillion in revenue from self-driving electric vehicles and robot taxis.

What will make Tesla so valuable, Musk believes, is that owners of self-driving electric vehicles will soon be able to rent them out, similar to Uber, and earn money.

Billionaire Elon Musk argues that this will change the entire automotive market.

“It’s crazy, right?” Elon Musk proudly said.

A history of broken promises

According to Fortune, Elon Musk has a long history of making ambitious promises that are either missed or not delivered.

In 2016, Elon Musk said that the fully autonomous driving, or FSD, feature would be available in 2017 on Tesla electric vehicles, allowing owners to “call” their cars without a driver in the car.

At the same time, the billionaire said that the prospect of autonomous driving without humans was only 1-2 years away from becoming common.

Then in 2019, although autonomous driving technology was not as common as Elon Musk said, the billionaire continued to predict that Tesla’s Robot Taxi service would be available in 2020.

In fact, Tesla’s FSD technology is under investigation by the National Transportation Safety Board (NTSB) for a series of crashes and still requires a human to sit behind the wheel to be ready to control the car, rather than being fully autonomous.

Meanwhile, Tesla’s Robot Taxi model will only be launched in 2024, 4 years after Elon Musk’s commitment. However, mass production is still a question mark because Tesla has not given any specific deadline or program for this product.

Tesla’s stock has increased 50% since the November 5, 2024 session after the election as investors bet that the electric car company would benefit from Elon Musk’s early access to President Donald Trump. However, the stock price fell 4% in the session after bad sales news in Germany.

News

The country singer melted many hearts at one of her recent concerts.

Country Fans Praise Singer for Making Bullied Fan ‘Feel Safe and Appreciated’ With Mid-Show Pep Talk ‘She just changed his…

Kelly Clarkson Reveals Which Singer She Is ‘Obsessed’ With As Fans Beg for a Collab

Clarkson ‘would really like’ the singer to appear on her show’s ‘Songs & Stories’ segment. Kelly Clarkson revealed which of today’s…

Inside Kid Rock and Audrey Berry’s 8-year relationship: From whirlwind romance to engagement.

Kid Rock and Audrey Berry’s Relationship Timeline: Find Out Amid The End of Their 8-Year-Long Engagement Kid Rock has ended…

LPGA Legend Regrets ‘Training Like a Man’ That Ultimately Forced Her to Step Away From Golf

Golf might be the gentleman’s game, but it can be cruel at times too. Sure, it does not involve the…

Phil Mickelson admits he ‘owes’ Tiger Woods a lot…

No Longer on Good Terms, Phil Mickelson Admits He Owes Tiger Woods Big Time During LIV Golf Event Was It…

John Daly’s Promise to Now Deceased Parents of Tiger Woods Throws Fresh Light on Relationship Between the Golfers

Building lasting friendships in the golf world is a tough job, especially when you’re dealing with superstars like John Daly and Tiger Woods….

End of content

No more pages to load