Elon Musk is about to lose 2 billion USD/year as the US considers stopping the sale of carbon credits, Tesla went from a profit of more than 400 million USD to a loss of 186 million USD

Elon Musk’s controversial statements are causing the billionaire to face many challenges from the government.

Fortune newspaper said Tesla, the electric car giant that once “monopolized” the market, is facing a potential major challenge from US energy policy.

News that the U.S. government is considering repealing or loosening corporate fuel efficiency (CAFE) standards is sending a wave of concern through Silicon Valley and Wall Street, raising questions about the future of one of Tesla’s “golden” sources of income: emissions credits.

Billion dollar pie

For years, while traditional automakers have struggled to transition to the electric era, Tesla has naturally benefited from the emissions credit system.

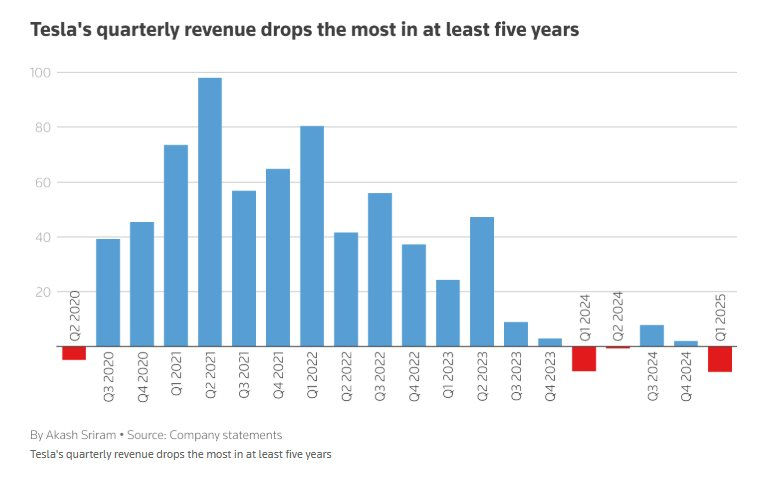

Tesla’s quarterly revenue

The CAFE program, which dates back to 1975, requires automakers to accumulate carbon credits based on the emissions per vehicle.

If they fail, they can buy “credits” from electric car companies like Tesla – which have far exceeded these targets, bringing in nearly 100% of profits for Elon Musk’s empire.

In fiscal 2024, an impressive figure was announced: Tesla earned $2.76 billion from selling emission credits.

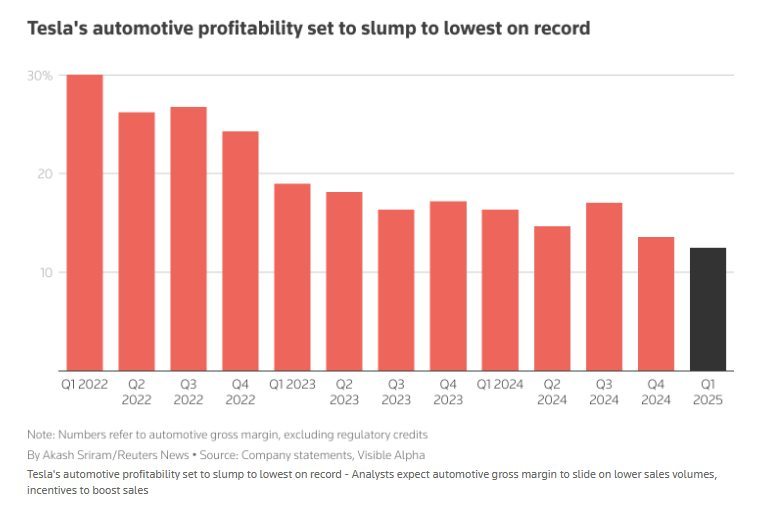

Not only did this figure jump 54% year-over-year, it also became an important “lifesaver”, especially when Tesla faced pressure to reduce vehicle prices and fierce competition, causing profit margins to narrow.

Politico even noted that credit revenue has accounted for less than 3% of Tesla’s total revenue since 2014, but contributed more than 32% of the company’s profits over the past decade.

However, this lucrative “pie” is at risk of shrinking or even disappearing if the US government decides to abolish CAFE.

This will directly affect Tesla’s net profit, forcing the company to find ways to compensate by increasing car sales or cutting production costs even more radically.

Given that Tesla has been cutting prices to boost sales, losing this source of revenue will put even more pressure on profit margins.

In its last quarterly report, Tesla recorded revenue of $19.34 billion and net income of $409 million, but it was the $595 million in credits that helped the company “turn a profit” instead of losing about $186 million. Without these credits, Tesla immediately fell into the red.

The first quarter net profit margin will plummet from more than 2% to less than 0.1%, which will directly affect the entire reinvestment and network expansion plan sooner or later.

Losing $2.76 billion in credit revenue per year would be equivalent to losing 2.83% of Tesla’s total 2024 revenue.

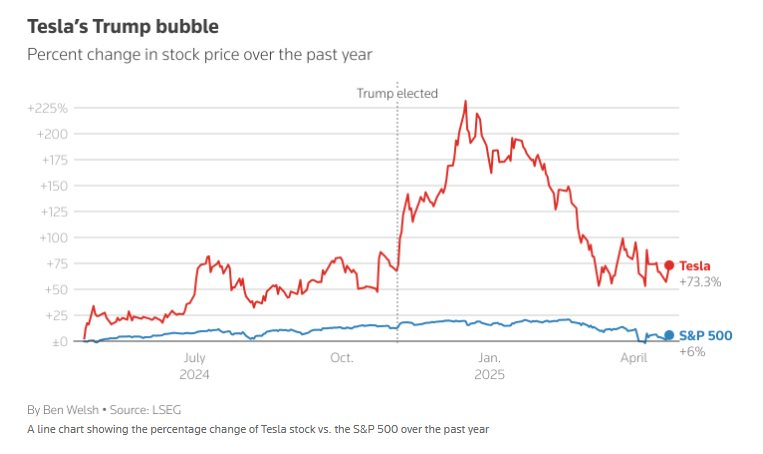

Tesla stock price change over the past year

Worse, JPMorgan Chase forecasts Tesla would lose $1.2 billion in annual profits without the $7,500 tax credit from the government for electric vehicle purchases, and could lose an additional $2 billion in annual profit credits if the repeal policy takes place.

Widespread influence

The CAFE standard is one of the main drivers pushing traditional automakers like General Motors, Ford, and Volkswagen to accelerate the electrification of their fleets.

Without these regulations, they may be less willing to invest heavily in research, development, and production of electric vehicles, or at least slow down the pace of the transition. This would slow the growth of the overall electric vehicle market, reducing Tesla’s potential for expansion.

With traditional manufacturers no longer under pressure for fuel efficiency, they can continue to focus on producing and selling low-cost internal combustion engine (ICE) models, which can be more profitable.

This would make ICE cars more competitive in price with Tesla electric cars, especially in the mass market segment, thereby reducing the appeal of electric cars to some consumers.

Although Tesla, under the leadership of Elon Musk, has demonstrated extraordinary adaptability and innovation, the abolition of CAFE will be a serious test of the company’s ability to finance itself without the “cushion” of credits.

Tesla’s quarterly profit growth

In April 2025, Tesla sales in 32 EU countries fell by 49%, while the total electric vehicle market grew by more than 28% – a clear sign that the company is facing fierce competition from Chinese and European brands.

The final decision by the U.S. government on CAFE will have far-reaching implications not only for Tesla, but for the entire U.S. auto industry and its goal of reducing carbon emissions. Investors and consumers are anxiously waiting to see how Tesla navigates this policy headwind.

News

Bunnie Xo didn’t hesitate to open up about why she gave Jelly Roll a second chance after the singer’s infidelity, but there would never be a “third time.”

Bunnie Xo Reveals Why She Gave Jelly Roll a Second Chance After Affair, But Would He Get a Third? ‘Absolutely…

Gwen Stefani was the “only person” to vote for Blake Shelton to be named “Sexiest Man in the World”.

Carson Daly Jokes Gwen Stefani Was the ‘Only One Voting’ the Year Blake Shelton Was Named Sexiest Man Alive The…

Lauren Alaina speaks out after becoming a victim of online body shaming that left her furious.

Country Star Issues Blunt Response After Being Criticized for Her Appearance: ‘I’m Seething’ Lauren Alaina is speaking out after falling victim…

Resurfaced clips of Kid Rock’s creepy comments about the underage Olsen twins are back to haunt us all

Kid Rock just can’t help making the news these days. If only it was for good reasons! This week alone,…

Unbelievable: Couple goes viral on social media for “BDSM love-fest” at Bailey Zimmerman concert.

Florida Couple Goes Mega-Viral For Shocking Display Of PDA At Bailey Zimmerman Concert I’m not going to yuck someone’s yum,…

Once highly praised by Elon Musk, an investment decision by Bill Gates turned into a disaster, resulting in losses exceeding $10 billion.

Once highly praised, one of Bill Gates’ investment decisions turned into a disaster, resulting in losses exceeding $10 billion More…

End of content

No more pages to load