Even longtime Tesla backers on Wall Street are saying Musk’s time to act is running out.

Tesla shares fell 9% in trading on Thursday after the company once again reported disappointing financial results.

Tesla’s revenue and profit both fell by double digits after the company reported its biggest sales decline in history. The electric carmaker is also facing a series of financial difficulties, including the loss of a $7,500 tax credit for electric car buyers in the U.S. starting in October, and the near-disappearance of the market for selling environmental credits, a business that Tesla has brought in $11 billion in revenue from since 2019.

However, Tesla CEO Elon Musk barely mentioned these issues during Wednesday’s earnings call, although he did admit that “the company could have a few tough quarters.”

Instead, he went on to share his grand vision for the future, including Tesla’s long-promised driverless taxi service, as well as the humanoid robot Optimus — still in development.

The lack of details on plans to address the immediate issues has frustrated some investors and analysts.

“Investors have been very forgiving of Tesla in recent quarters, despite the obvious difficulties in the business,” Garrett Nelson, an analyst at CFRA Research, told CNN on Thursday. “But I think they’re becoming more realistic now. Part of Musk’s genius is getting investors to focus on the long-term and ignore the short-term or medium-term problems. But now those difficulties are so obvious that they’re hard to ignore.”

Nelson downgraded Tesla shares to neutral in April. But even longtime Tesla supporters on Wall Street are saying Musk’s time to act is running out.

“Wall Street is starting to lose patience,” Dan Ives, a technology analyst at Wedbush Securities, told CNN, although he still believes in the vision of autonomous vehicles and artificial intelligence that Musk and Tesla are pursuing.

Overly ambitious promises?

Musk has made a number of bold claims about Tesla’s robotaxi service, including promising the service would be rolled out within a year, starting in 2019.

Tesla’s robotaxi finally launched in June, but only on a very limited scale in Austin, Texas—to friends and fans of the company, with an employee sitting next to the empty driver’s seat. But the limited launch didn’t stop Musk from making extraordinary claims on Wednesday, saying the service would be available to half the US population by the end of the year. To get there, Tesla will need to get permits to operate in two states every week by the end of the year—including New York, which currently bans self-driving cars.

Seth Goldstein, an analyst at Morningstar, said he believes Tesla will eventually succeed with robotaxis, “but the software needs further testing” and he doesn’t expect a full robotaxi product to be available before 2028.

But Musk has a history of making big promises that fall short.

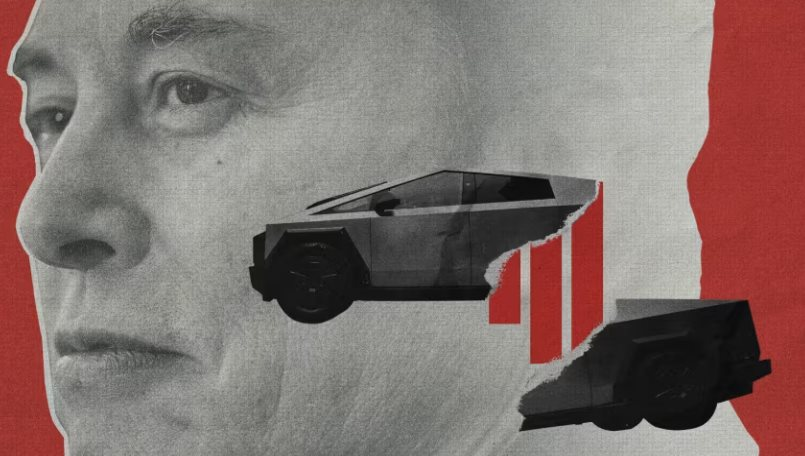

Take the Cybertruck, Tesla’s only new vehicle in six years. Musk once said Tesla would be producing 250,000 a year by now. But combined annual sales of the Cybertruck and Tesla’s two other expensive models totaled less than 80,000. Sales of all three models plunged 52% in the most recent quarter.

Tesla also started 2025 expecting sales growth after posting its first year of decline in history in 2024. But after two consecutive quarters of record sales declines, most investors now think that goal will be unattainable.

And when Elon Musk himself barely mentioned car sales during the hour-long meeting, it seems that even that is no longer enough to satisfy shareholders.

“We have a mixed view on Tesla’s ability to meet its robotaxi timeline, cost and scalability targets,” Baird analyst Ben Kallo wrote in a note to clients Wednesday evening.

“Tesla has been overlooked so far because of how bold and innovative its products are, but if the auto business continues to stagnate, investors will return to paying more attention to short-term issues.”

News

The long-standing conflict between Rosie O’Donnell and Donald Trump flared up again after she called for the president to resign.

Rosie O’Donnell demands Trump’s removal from office over Kennedy Center honor in latest tirade White House previously said O’Donnell suffers…

Ella Langley Just Accomplished Something No Other Solo Female Country Artist Has in This Decade

Ella Langley has added another entry to the record books. The country singer’s track “Choosin’ Texas” has been collecting records…

Blake Shelton and John Legend’s Christmas party was chaotic. And the Christmas tree wearing a tattered cowboy hat was the highlight!

Blake Shelton’s Christmas Tree Topper Had John Legend Frazzled: “What Is This?” If only The Oddest Couple, starring The Voice Coaches, became a…

MICHAEL Buble has given fans a rare glimpse into his home life following his shock departure from The Voice.

Michael Buble gives rare glimpse into his home life as he releases surprise documentary after leaving The Voice The singer, 50, stepped…

The lawsuit involving a woman claiming to be Miley Cyrus’s mother has become even more outrageous after she decided to reveal the truth about the story.

Woman Who Claims To Be The Mother Of Miley Cyrus Reveals Why She Chose That Name…Except Miley Isn’t Actually Her…

The country singer admitted that he not only swam naked in Jason Aldean’s pool but also urinated in it.

Country music star admits he went skinny dipping and peed in Jason Aldean’s pool Country music singer Tyler Farr revealed…

End of content

No more pages to load