Former Stellantis CEO: Elon Musk may leave the electric car industry, Tesla will disappear in the next 10 years under pressure from BYD

For more than a decade, Tesla has been a beacon of light for the global auto industry, a symbol of the shift to clean energy, the pace of technological innovation, and Elon Musk’s vision of the future. But according to former Stellantis CEO Carlos Tavares, that era may be coming to an end.

In an interview with Les Echos (France), the veteran leader said that Tesla could withdraw from the automotive sector and even disappear within the next 10 years, under increasing pressure from Chinese competitors, especially BYD. Worse, Elon Musk could shift his attention to other areas instead of focusing on reviving Tesla.

Tesla’s stock price is currently too high and depends largely on Elon Musk’s reputation. Therefore, the billionaire’s distraction and departure could create a chain collapse.

Abandonment

Former CEO Tavares, who once led Stellantis, the parent company of Jeep, Peugeot and Citroën, said Tesla is under strong pressure from BYD, a Chinese automaker that has now surpassed Tesla in global electric vehicle sales.

Former Stellantis CEO Carlos Tavares

BYD Group not only competes on price, but also excels in productivity and large-scale production capabilities. While Tesla is still associated with high-tech and premium products, BYD dominates the mass market segment, where the market is growing fastest.

According to IEA data, global electric vehicle sales will exceed 17 million units in 2024, with the majority coming from China. In this market, Tesla’s market share has dropped from 16% in 2020 to around 5%, although sales are still up 33% over the same period.

By contrast, BYD has leveraged its domestic manufacturing advantages, closed battery supply chain and competitive pricing strategy to expand its influence globally, from Asia to Europe.

In that context, former CEO Tavares did not hesitate to warn: “Tesla is an innovative corporation, but they will be beaten by BYD’s performance. I’m not sure that Tesla will still exist in 10 years.”

Tavares’ warning is not just aimed at Tesla, but also at Elon Musk, whose focus has increasingly been divided. The world’s richest man is now not only “CEO of Tesla,” but also the leader of SpaceX, Neuralink, xAI, and recently a senior member of the Trump administration, in charge of the Department of Government Efficiency.

Former CEO Tavares hypothesized that Elon Musk could leave the auto industry to focus on other areas such as humanoid robotics or artificial intelligence (AI), which he sees as the real future of humanity.

“It is not impossible that he will decide to leave the auto industry to focus on SpaceX, AI or robotics. Elon Musk may leave the electric car industry,” Tavares said.

This is not without basis. In recent years, Musk has devoted more attention to the Optimus robot project and the AI operating system, considering it the long-term foundation for “Tesla 2.0”.

But it is this direction that makes investors worried: is Tesla still an auto company, or is it turning into a vague technology corporation lacking a clear direction?

Many analysts worry that Tesla’s refocus on self-driving technology (FSD/Robotaxi) and humanoid robots (Optimus) could be a big gamble.

The lack of new models for regular drivers poses a big risk for investors and could make it difficult for Tesla to sustain growth without regular model launches.

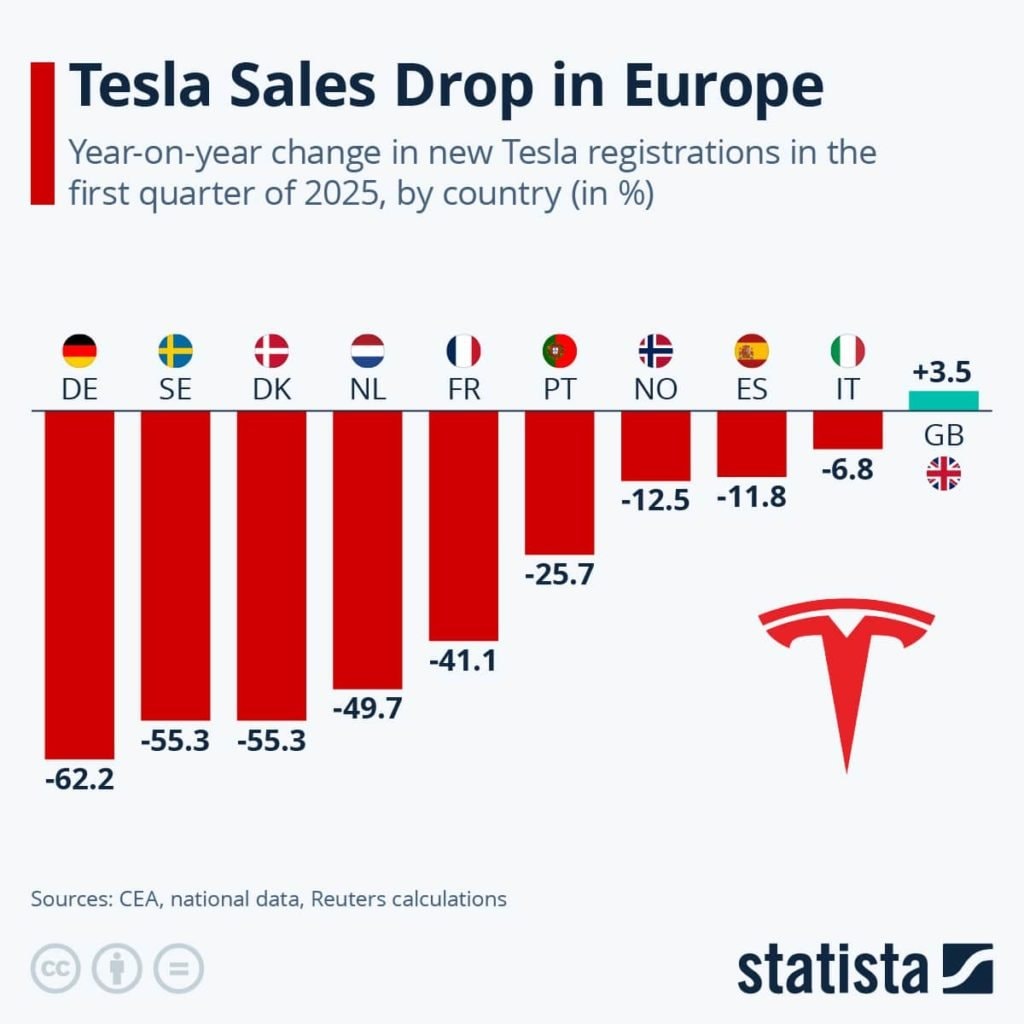

Tesla Q1/2025 sales plummet in Europe (%)

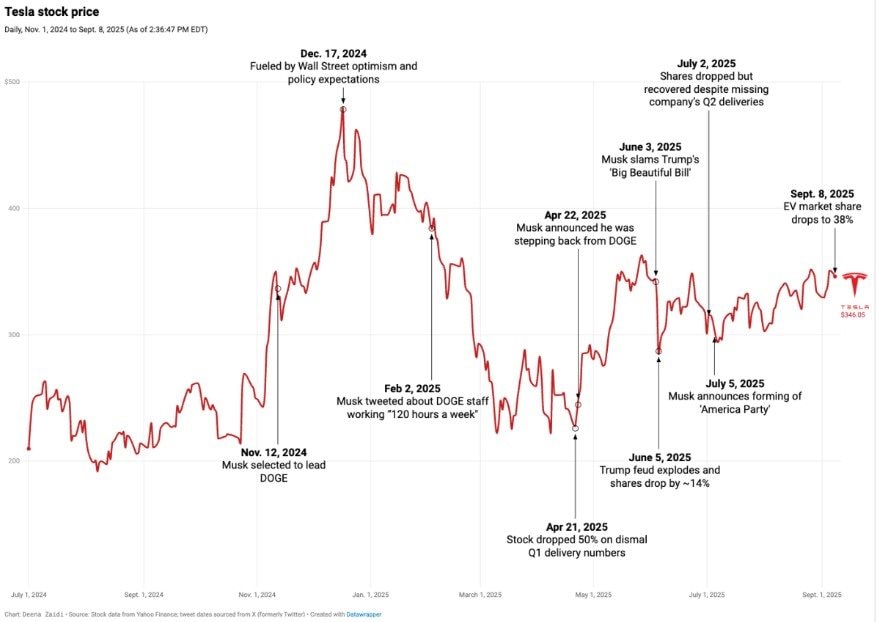

Tesla stock price

Car sales remain the foundation for expanding the user base, generating data for autonomous driving development, and ultimately driving software revenue (FSD). However, neglecting the core car segment could undermine that foundation.

Risk of collapse

On the other hand, former CEO Tavares called Tesla’s market cap “strategically high.” Although the company’s most recent quarterly revenue was $28 billion, up 12% year-over-year, that growth is being eroded by competition. Tesla’s stock plunged 39% in March before recovering slightly and is up just 8.6% year-to-date.

Tesla’s gross margins have fallen significantly (from a peak of 17% in 2022 to 3.4% in the first half of 2025) as it has had to cut prices repeatedly to defend its market share, especially in China and Europe, against price competition from BYD. Tavares has even warned of a “bloodbath” if EV makers follow Tesla’s “race to the bottom” pricing strategy.

Analysts say that Tesla’s value largely reflects trust in Elon Musk rather than sales or profits. So if Musk leaves or loses focus, that trust structure could collapse, causing a domino effect across the entire US electric vehicle market.

Tesla is looking to back that up with a $1 trillion compensation package over 10 years for Musk, along with a goal of taking the company’s market capitalization to $8.5 trillion.

However, two major shareholder advisory organizations have recommended against it, arguing that Tesla’s board has too much discretion in evaluating Musk’s performance.

Additionally, Tesla’s sky-high market capitalization reflects investors’ belief that the company is a technology company, not just an automaker. However, Tavares argues that this valuation could lead to huge losses if Tesla fails to prove its efficiency and profitability against BYD’s competition.

Fortune newspaper commented that if Tesla cannot maintain its advantage in technology, cost and products, the risk of being “left behind” by BYD and other Chinese companies is real.

The proof is that while Chinese competitors continue to launch new models in short cycles, Tesla relies on old models (Model 3 and Model Y) and bets its future on breakthrough technologies such as self-driving cars (Robotaxi) and humanoid robots. Mr. Tavares believes that this strategy is too risky and unsustainable in the long term.

In the worst case scenario, if Elon Musk does indeed leave the automotive industry, Tesla could lose the innovative soul that has kept it ahead of all competitors for a decade. And as Tavares says, Elon Musk’s departure from the electric vehicle industry could spell the end of Tesla’s golden age.

Carlos Tavares’s statement is not only a bold prediction, but also a warning. Tesla is at a crossroads: either reposition itself in the fierce race with China and refocus on its core, or become a passing icon.

If that happens, “Tesla disappearing in 10 years” may no longer be a science fiction prediction, but a completely possible scenario.

News

Inspired by David Beckham’s $1 billion win, Harry Styles decided to sue counterfeiters.

Harry Styles launches lawsuit inspired by David Beckham’s $1billion victory One Direction singer Harry Styles files case against counterfeiters One…

Charley Hull has opened up for the first time about her painful divorce from her ex-husband, MMA fighter John “Ozzie” Smith.

Charley Hull Opens Up on Traumatic Divorce from Ex-Husband for the First Time Ever At just 23, Charley Hull surprised many when…

Firerose recently shared a video exposing Billy Ray Cyrus’s ‘crimes’ in their relationship – and that video was anything but cute.

Country singer’s ex-wife alleges abuse in scathing video: ‘Control, isolation, rage, manipulation’ NASHVILLE, TENNESSEE – AUGUST 23: (L-R) FIREROSE and…

Billy Ray Cyrus demands thousands from woman claiming to be Miley Cyrus’ biological mom after she files bombshell lawsuit

The star had previously been on the receiving end of an unusual lawsuit relating to Miley Cyrus Billy Ray Cyrus…

“Not Walking Down the Aisle,” Riley Green and Ella Langley Join Country Music’s Elite Club.

Riley Green and Ella Langley Joins the Ranks of a Country Music Power Couple in the Record Books In June…

The Democratic Party released new photos of pedophile billionaire Epstein: Including President Trump and former President Clinton.

The Democratic Party releases new photos of pedophile billionaire Epstein. Democratic lawmakers have released new documents about pedophile billionaire Epstein,…

End of content

No more pages to load