Will history repeat itself when Elon Musk bought Twitter for $43 billion in 2022?

According to the Financial Times (FT), it all started with a refusal of Starlink internet service from the budget airline Ryanair, which quickly escalated into a heated war of words.

Things then escalated when the world’s richest billionaire, Elon Musk, publicly questioned his 200 million X followers about whether he should buy Ryanair and fire CEO Michael O’Leary.

Under scrutiny

It all started when Michael O’Leary, CEO of Ryanair, bluntly stated that he would not install Musk’s Starlink satellite internet system on the airline’s planes. O’Leary’s reasoning perfectly reflected Ryanair’s “squeeze the bucket” philosophy: installing the equipment would increase aerodynamic drag, causing the aircraft to consume more fuel and cost the airline approximately $250 million annually.

CEO O’Leary, known for his blunt speaking style, directly attacked Musk’s technical capabilities when he declared on Ireland’s Newstalk radio station: “What Elon Musk knows about flight and aerodynamic drag is zero. I really don’t care about anything Musk posts on that garbage dump he calls X.”

In response, Musk called O’Leary an “absolute fool” and began conducting polls about acquiring Europe’s largest low-cost airline.

However, according to the FT, despite Elon Musk’s enormous wealth, acquiring Ryanair is a far more complex financial and legal undertaking than the previous Twitter deal.

Currently, Ryanair’s market capitalization is around $35 billion. Notably, the airline has an extremely healthy balance sheet and is expected to clear all its debt in the next few months.

Investors seemed unimpressed by Musk’s statements. Ryanair’s stock price remained largely unchanged after the Tesla CEO’s posts, suggesting the market viewed this as merely a media “war of words” rather than a serious acquisition attempt.

It’s worth remembering that when Musk acquired Twitter for $44 billion in 2022, he had to mortgage a significant portion of his Tesla stock to raise capital.

With Tesla facing fierce competition and projects like xAI and SpaceX consuming massive amounts of cash, pouring tens of billions of dollars into a thin-margin and high-risk industry like aviation is a financially impractical move.

While O’Leary views Wi-Fi as a cost burden, major competitors are taking entirely different approaches. Lufthansa recently announced free Starlink installation for loyal customers, while British Airways has also signed a similar agreement to provide free internet to all passengers.

United Airlines is even more ambitious, aiming to turn Wi-Fi into an exclusive communication platform. By using passenger data to personalize advertising (for example, suggesting Uber rides at their destination directly on the plane), United expects to generate an additional $350 million annually by 2028.

For Ryanair, the additional $250 million in fuel costs is equivalent to about $1 per passenger the airline carries annually. If they know how to leverage data for advertising or selling ancillary services like United, this cost could be fully offset.

12-month net profit margin of airlines (%)

However, with Ryanair focusing on short-haul routes, the need for connectivity is typically lower compared to longer flights, further reinforcing O’Leary’s position.

A media stunt?

The Financial Times noted that even if Musk had enough cash, he would still face an almost insurmountable hurdle: EU airline ownership regulations. Under current law, airlines based in the bloc must be majority-owned (over 50%) by citizens of the EU or countries within the European Economic Area.

Since Brexit, Ryanair has implemented strict controls on non-EU shareholders to protect its right to operate flights within the bloc. Although the airline eased some restrictions last year after identifying more than half of its shareholders as being on the approved list, individuals who are not EU citizens still have limited voting rights.

Therefore, as an American citizen, Elon Musk would never be able to directly control Ryanair unless he had European investors acting as nominees.

However, instead of buying Ryanair entirely, Musk has a cheaper and far more “cunning” option: offering Starlink at a special discounted price to Ryanair’s direct competitors such as easyJet or Wizz Air.

If these competitors deploy free Wi-Fi and begin to gain market share, O’Leary may be forced to compromise and accept Starlink in order to remain competitive.

From another perspective, both Elon Musk and Michael O’Leary are masters of personal communication. Both frequently use shocking statements to attract public attention without spending on traditional advertising.

For O’Leary, attacking Musk helps reinforce Ryanair’s image as a pragmatic airline, always prioritizing low costs for customers over luxury amenities. Conversely, for Musk, polls on X help maintain engagement and turn the platform into a center of global discussion.

This battle will likely end with sarcastic social media posts and pointless polls. Ryanair even responded with characteristic humor, declaring, “In-flight WiFi is just propaganda.” It seems that in this battle between “visions to Mars” and “the wallets of ordinary passengers,” both billionaires have achieved a common goal: getting their names mentioned worldwide.

News

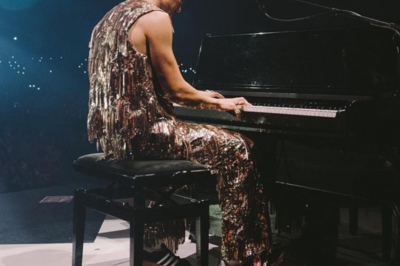

Harry Styles Will Release the First Single for His New Album This Week

Everything We Know About Harry Styles’s Fourth Album, Kiss All the Time. Disco, Occasionally. After a monumental run with three studio…

Randy Travis’s wife, Mary, has just revealed the country star’s miraculous ‘recovery’ after doctors told her she should ‘remove the breathing tube’ from him.

Country music icon’s doctors told his wife he was dying. Here’s what happened next Randy Travis continues to tour and…

Jack Nicklaus has revealed who he believes is the greatest golfer of all time, and it’s not Tiger Woods.

Who Jack Nicklaus named as the greatest golfer of all time, even ahead of Tiger Woods Photo by Stuart Kerr/R&A/R&A…

Tiger Woods left stunned as Justin Rose makes TGL history in front of him

Justin Rose produced a stunning albatross to make history in TGL on Tuesday night. The former US Open champion left Tiger…

John Cena was amazed by Kane Brown’s enviable car collection.

John Cena Is Impressed With This Country Star’s Enviable Car Collection—and You’ll Be Too Cars are the central premise of…

Greg Biffie’s Home Burglarized Weeks After Tragic Plane Crash That Claimed His Life and Family

You’d think death would be enough. But for Greg Biffie’s family, tragedy didn’t stop with a plane crash. In a…

End of content

No more pages to load