There have been no clear signs of Tesla’s recovery this year, despite a sharp drop in its stock price.

Tesla shares have plunged 48% since their peak in mid-December, but the current price is not attractive enough for longtime investor Ross Gerber to buy again.

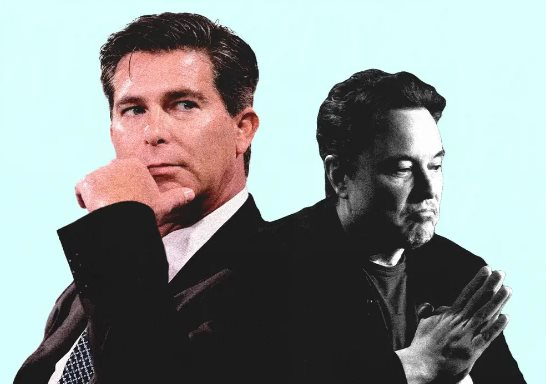

Gerber, who invested in Tesla years ago, scooping up the stock at a low point before it exploded, is now chairman and CEO of Gerber Kawasaki Wealth & Investment Management, which oversees about $3 billion in assets.

Last month, he told Business Insider that he predicted Tesla’s stock price could fall by up to 50% this year, as CEO Elon Musk is focusing more on other projects like DOGE, SpaceX, xAI, and social network X.

Gerber’s prediction quickly came true. Although Tesla’s stock had been falling since before the interview, the decline has only become more pronounced. As of Wednesday’s close, the stock had fallen another 31% since his late February comments.

Now, Gerber is sticking to that stance. In a new interview with BI, he said he doesn’t see any clear signs of Tesla’s recovery this year, despite the steep decline in its stock price.

Notably, Gerber has not hesitated to act on his words. According to legal filings, in 2024, he reduced his Tesla shares held by the company by 31%, to 262,000 shares, worth about $106 million at the end of last year.

In a recent speech, the once-optimistic but now-skeptical Tesla expert continued to emphasize the view that, even after the sharp correction, Tesla’s stock price is still too high.

So what does Tesla need to do to get its stock back on track?

The answer, according to Gerber, is simple but not easy to implement: The company’s profits must grow again.

“If Tesla were to achieve earnings per share (EPS) of around $5 and be valued at 50 times EPS, the stock could go as high as $250,” Gerber said. “But Tesla is not currently in a position to achieve that.”

Tesla’s earnings per share will fall 52% to $2.04 in 2024. Analysts expect that figure to recover to $2.75 in 2025 and $3.65 in 2026.

However, the above forecasts have recently been questioned amid economic uncertainty and a continued decline in global Tesla car sales.

Gerber believes that Elon Musk’s divisive political moves are and will continue to be a major obstacle for the Tesla brand. Gerber believes that Musk has unintentionally driven customers away from Tesla with his reckless political stances and actions.

In that context, Gerber said the current decline in Tesla’s stock, which was once valued at 150 times earnings, “is completely unsurprising.”

TOO EXPENSIVE

Gerber stressed that Tesla’s current valuation is still very high, even after the stock has just experienced a sharp decline.

At the close of trading on Wednesday, Tesla’s forward P/E ratio was still up to 65 times, more than three times the average of the S&P 500 index.

At this price, Gerber said Tesla shares are far from a bargain, especially as analysts have revised down their 2025 sales forecasts for two consecutive years.

“From a traditional investor’s perspective, this stock doesn’t fit into any valuation system,” Gerber said.

“Especially in the current market environment, when you can buy Nvidia at a P/E ratio of around 20 times,” he added. “Plus, Nvidia’s expected earnings are up 75% this year, and the company is aggressively buying back shares.”

The broader stock market is also putting pressure on Tesla’s valuation multiple. Gerber said investors will likely continue to undervalue Tesla as long as the economic picture remains clouded by Trump’s tariffs.

The next question is how the market perceives Tesla’s growth prospects over the next five years.

“The market is now forced to reassess Tesla’s fundamental story. Even if Tesla were valued at 50 times future earnings—about $290 a share—with EPS of only $3, the fair value would be $150,” Gerber explains. “And yet the stock is still hovering around $225, with the potential to fall to $150.”

THE “OLD CAR” NIGHTMARE

One of Tesla’s biggest problems turns out to stem from the company’s own product quality.

Gerber calls this the “Apple problem,” where products are built to last long enough that customers don’t feel the need to upgrade frequently.

“Tesla cars are very durable, they don’t degrade easily, so the need to buy a new one to replace them is very low, because the cars can run well for a long time,” Gerber analyzed. “They have the same problem as Apple: The phones are so good, they never break. A 5-year-old Tesla is almost indistinguishable from a 2-year-old car.”

This, combined with a wave of users wanting to sell their electric cars in response to Elon Musk’s controversial political statements, has caused the value of used Tesla cars on the market to drop rapidly.

When used Tesla cars are so cheap and the quality is almost the same as new cars, there is even less reason for users to buy cars directly from the company.

“Unless Tesla’s new models are technologically superior to their old ones, there will be no compelling reason for consumers to upgrade, especially those who are cost-conscious in an inflationary environment,” Gerber said. “This is clearly hurting Tesla, because the used car market is not only not helping them, but directly hurting them.”

News

Harry Styles opens up about ‘inappropriate behaviour’ at grandma’s funeral

Harry Styles makes bizarre confession in latest podcast interview Harry Styles makes bizarre confession in latest podcast interview Harry Styles…

Former Elon Musk employee leaked data to OpenAI; judge’s ruling sends shockwaves through the tech world.

A U.S. federal judge has dismissed a lawsuit alleging that OpenAI stole trade secrets from Elon Musk’s xAI, stating that…

BREAKING: Tiger Woods warned he could cause division on the PGA Tour

Tiger Woods Warned of Causing Rift in PGA Tour as Controversial Policies Take Over The growing chasm on the PGA…

UNBELIEVABLE!! John Daly has removed Tiger Woods from his list of the greatest golf legends.

Golf cult hero John Daly names his Mount Rushmore but controversially snubs Tiger Woods JOHN DALY has snubbed Tiger Woods…

Bunnie Xo didn’t hesitate to open up about why she gave Jelly Roll a second chance after the singer’s infidelity, but there would never be a “third time.”

Bunnie Xo Reveals Why She Gave Jelly Roll a Second Chance After Affair, But Would He Get a Third? ‘Absolutely…

Gwen Stefani was the “only person” to vote for Blake Shelton to be named “Sexiest Man in the World”.

Carson Daly Jokes Gwen Stefani Was the ‘Only One Voting’ the Year Blake Shelton Was Named Sexiest Man Alive The…

End of content

No more pages to load