Elon Musk doesn’t worry me. He’s not the richest man in the world by luck.

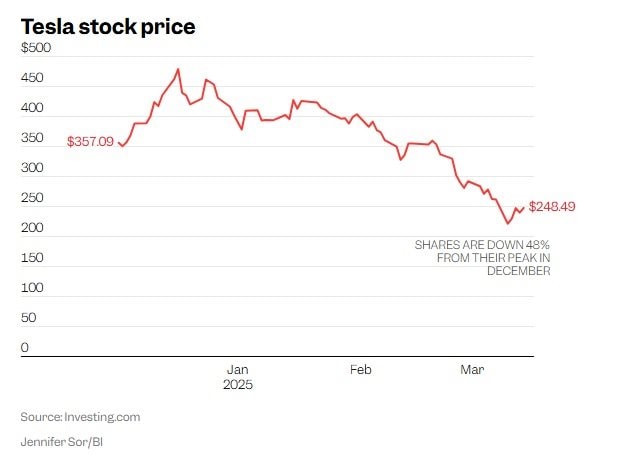

Tesla shares are now trading nearly 50% below their December peak, wiping $800 billion off the company’s market capitalization. But the sharp decline doesn’t seem to have deterred retail investors, who say they’ll continue to hold Tesla despite the losses — and in fact, see it as an opportunity to add to their holdings.

Retail investors interviewed by Business Insider said the recent sell-off was an overreaction by the market, despite concerns from large hedge funds about Tesla’s electric vehicle (EV) business, as well as the impact of CEO Elon Musk’s political ambitions and side projects.

Tesla shares edged up 3% in morning trading Friday to around $248 a share, but are still down nearly 50% from their all-time high of $479.86 set in December.

Neil Rozenbaum, a retail investor who started buying Tesla shares in 2019, said he was undaunted by the recent sell-off. Accustomed to market volatility, Rozenbaum sees the plunge as an overreaction by traders.

“I’ve been through selloffs before, whether with Tesla or other companies, so this doesn’t bother me too much,” Rozenbaum said in an interview with Business Insider.

Rozenbaum said he bought about $10,000 more in Tesla shares last Friday, when Tesla posted its seventh consecutive weekly loss, just before Monday’s 15% drop. While Tesla’s sales have been declining in recent months, Rozenbaum said he remains bullish on the company’s prospects, especially if Tesla releases an updated version of the Model Y this year.

When asked about Elon Musk’s political activities — which some investors say could harm the Tesla brand — Rozenbaum appeared unconcerned.

“It would take a lot of serious factors for me to sell Tesla stock. I would only consider selling if Tesla’s business really took a downturn or Elon Musk stepped down as CEO,” he said.

“I like Elon Musk, that’s probably why I bought Tesla stock. Without him, Tesla wouldn’t be as big as it is now. Honestly, I’m a fan of what Musk is doing.”

Fabian Varcianna, who first bought Tesla stock in 2022, also said he wasn’t ready to give up on his investment. Despite concerns about vehicle sales, Varcianna remains bullish on Tesla’s artificial intelligence (AI) and Full Self-Driving software, which he said is leading the market.

“People who criticize Tesla’s technology have never really studied it closely,” Varcianna told BI.

Varcianna, who added about $24,000 worth of Tesla stock over several trading days last week, said he wasn’t too concerned about Musk’s role in the new administration, especially at the Department of Government Efficiency.

“I don’t idolize anyone, but Musk doesn’t worry me. He’s not the richest man in the world by luck,” Varcianna said.

Varcianna said he would consider selling the stock if Tesla fell below $200 within the next six weeks — a drop of about 20% from Friday’s closing price.

“I have been profitable in Tesla for the past few years. There is no reason to rush to sell now,” he said.

Bilaal Dhalech, a trader who said he has been investing in Tesla since 2023, also bought another $4,000 worth of Tesla shares on Monday, the same day Tesla’s stock price fell 15%.

“If the price continues to fall, I will buy more,” Dhalech told BI.

While Dhalech is a little concerned about Tesla’s car sales, he remains optimistic about the company’s other projects. He’s particularly bullish on Tesla’s Robotaxi service and the humanoid robot Optimus.

“To be honest, I’m not a big fan of Tesla’s electric cars. My faith lies mainly in AI and autonomous technology,” he said.

Dhalech admits he’s a little concerned about the amount of time Musk spends on political activities, but that doesn’t affect his investment decisions.

“It’s true that Musk doesn’t have much time to focus on Tesla, but that’s the reality when you run multiple companies at the same time. I don’t let politics or public opinion influence my investment decisions. Tesla’s stock price is down 50%, and that’s an opportunity to make money,” he shared.

But Dhalech is cautious about the stock’s upside potential. If Tesla returns to its highs or experiences serious delays in its robotics and autonomous technology projects, he said he would sell a significant portion of his shares.

“Actually, I also expect Musk to tone down his interest in DOGE by the end of this year,” Dhalech added.

News

Riley Gaines: ”Simone Biles deleted X account to pretend nothing happened”

Riley Gaines Reacts To Simone Biles Deleting Her X Account After Feud Over Trans Athletes Biles deletes X account after…

Sydney Sweeney – The girl with ‘the most beautiful breasts in Hollywood’ once made Harry Styles ‘crazy’ for a while

She’s got the ‘best breasts in Hollywood’ – here’s all the A-list men who want to date her! Even weeks…

Drivers using Tesla have just realized that this name has a very special meaning that few people know thanks to Elon Musk

Drivers are just realising why Elon Musk’s car company is called Tesla Tesla is one of the most famous car…

“Steve Rider admits he’s ‘still bitter’ after Gary Lineker ‘took away his livelihood’.”

‘Gary Lineker stole my job at the BBC – he was the wrong man and we haven’t spoken since’ Steve…

”Tommy Fleetwood still lost on the PGA Tour but he still won in the hearts of his family”

What Tommy Fleetwood’s Wife Did Right After His PGA Tour Dreams Turned to Dust Speaks Volumes After 159 attempts, Tommy…

Is Amanda Balionis Really Divorced? Everything We Know About Her Relationship With the NFL Player

Amanda Balionis divorce rumors: Everything we know about her relationship with NFL player Amanda Balionis and husband Bryn Renner have…

End of content

No more pages to load