Elon Musk doesn’t worry me. He’s not the richest man in the world by luck.

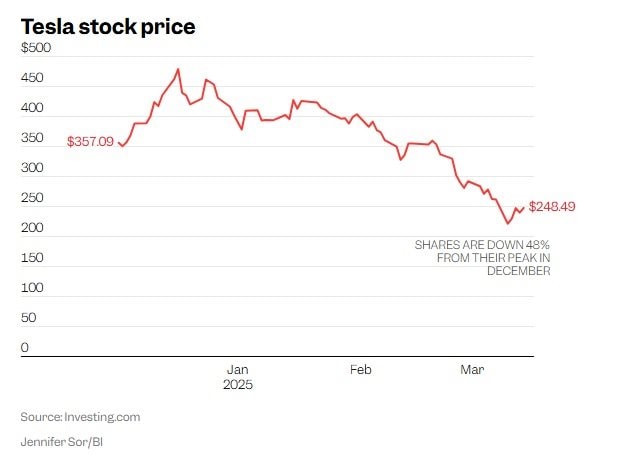

Tesla shares are now trading nearly 50% below their December peak, wiping $800 billion off the company’s market capitalization. But the sharp decline doesn’t seem to have deterred retail investors, who say they’ll continue to hold Tesla despite the losses — and in fact, see it as an opportunity to add to their holdings.

Retail investors interviewed by Business Insider said the recent sell-off was an overreaction by the market, despite concerns from large hedge funds about Tesla’s electric vehicle (EV) business, as well as the impact of CEO Elon Musk’s political ambitions and side projects.

Tesla shares edged up 3% in morning trading Friday to around $248 a share, but are still down nearly 50% from their all-time high of $479.86 set in December.

Neil Rozenbaum, a retail investor who started buying Tesla shares in 2019, said he was undaunted by the recent sell-off. Accustomed to market volatility, Rozenbaum sees the plunge as an overreaction by traders.

“I’ve been through selloffs before, whether with Tesla or other companies, so this doesn’t bother me too much,” Rozenbaum said in an interview with Business Insider.

Rozenbaum said he bought about $10,000 more in Tesla shares last Friday, when Tesla posted its seventh consecutive weekly loss, just before Monday’s 15% drop. While Tesla’s sales have been declining in recent months, Rozenbaum said he remains bullish on the company’s prospects, especially if Tesla releases an updated version of the Model Y this year.

When asked about Elon Musk’s political activities — which some investors say could harm the Tesla brand — Rozenbaum appeared unconcerned.

“It would take a lot of serious factors for me to sell Tesla stock. I would only consider selling if Tesla’s business really took a downturn or Elon Musk stepped down as CEO,” he said.

“I like Elon Musk, that’s probably why I bought Tesla stock. Without him, Tesla wouldn’t be as big as it is now. Honestly, I’m a fan of what Musk is doing.”

Fabian Varcianna, who first bought Tesla stock in 2022, also said he wasn’t ready to give up on his investment. Despite concerns about vehicle sales, Varcianna remains bullish on Tesla’s artificial intelligence (AI) and Full Self-Driving software, which he said is leading the market.

“People who criticize Tesla’s technology have never really studied it closely,” Varcianna told BI.

Varcianna, who added about $24,000 worth of Tesla stock over several trading days last week, said he wasn’t too concerned about Musk’s role in the new administration, especially at the Department of Government Efficiency.

“I don’t idolize anyone, but Musk doesn’t worry me. He’s not the richest man in the world by luck,” Varcianna said.

Varcianna said he would consider selling the stock if Tesla fell below $200 within the next six weeks — a drop of about 20% from Friday’s closing price.

“I have been profitable in Tesla for the past few years. There is no reason to rush to sell now,” he said.

Bilaal Dhalech, a trader who said he has been investing in Tesla since 2023, also bought another $4,000 worth of Tesla shares on Monday, the same day Tesla’s stock price fell 15%.

“If the price continues to fall, I will buy more,” Dhalech told BI.

While Dhalech is a little concerned about Tesla’s car sales, he remains optimistic about the company’s other projects. He’s particularly bullish on Tesla’s Robotaxi service and the humanoid robot Optimus.

“To be honest, I’m not a big fan of Tesla’s electric cars. My faith lies mainly in AI and autonomous technology,” he said.

Dhalech admits he’s a little concerned about the amount of time Musk spends on political activities, but that doesn’t affect his investment decisions.

“It’s true that Musk doesn’t have much time to focus on Tesla, but that’s the reality when you run multiple companies at the same time. I don’t let politics or public opinion influence my investment decisions. Tesla’s stock price is down 50%, and that’s an opportunity to make money,” he shared.

But Dhalech is cautious about the stock’s upside potential. If Tesla returns to its highs or experiences serious delays in its robotics and autonomous technology projects, he said he would sell a significant portion of his shares.

“Actually, I also expect Musk to tone down his interest in DOGE by the end of this year,” Dhalech added.

News

Late Golf Legend’s Son Left Distraught as Life-Sized Statue of His Father Is Stolen from Hometown

A quiet seaside town in Spain woke up to an empty space where a powerful tribute to the legend Seve…

Elon Musk and Sam Altman are once again locked in a fierce war of words: from warnings to boycott ChatGPT to accusations about Tesla’s vehicle safety.

The already strained relationship between billionaire Elon Musk and OpenAI CEO Sam Altman has escalated further with a new online…

‘Real-life Batman’: Elon Musk considers acquiring an airline after heated online feud.

Will history repeat itself when Elon Musk bought Twitter for $43 billion in 2022? According to the Financial Times (FT),…

“Get to Know the Heartbeat of Nashville”: ERNEST Hails Post Malone as the Perfect Example of How to Make a Country Crossover Album

A host of pop-leaning artists such as Beyoncé, Lana Del Rey and MGK have all ventured into country music in…

Country Icon Carrie Underwood Recalls the Signature No. 1 Hit That Almost Didn’t Get Cut 20 Years After Its Release

‘It was almost, ‘Maybe we don’t do this song,’ the country star, 42, remembered while reflecting on her debut studio…

“God Bless Country & Christian Music”: Brandon Lake Teases Massive Country Project Featuring Lainey Wilson, HARDY, & Many More

Pulling out all the stops. Against all odds, it seems like one of the biggest trends in country music heading…

End of content

No more pages to load