Revenue up but stock down: What’s going on with this billionaire’s electric car company?

Tesla’s third-quarter revenue rose 12%, marking a turnaround after two consecutive quarters of decline, but shares fell nearly 5% in after-hours trading as profits missed expectations.

The Tesla machine is revving up again after two quarters of revenue declines. But behind the recovery lies a complex picture – where AI costs, tax policy and investor confidence are testing Elon Musk.

After two consecutive quarters of slowdown, Tesla just recorded revenue growth of 12% in the third quarter, reaching $28.1 billion, exceeding analysts’ expectations. However, profits bucked the trend: net income fell 37%, to $1.37 billion, or 39 cents per share, compared to 62 cents in the same period last year.

Investors reacted immediately, sending Tesla shares down nearly 5% in after-hours trading, as the results showed that the largest electric car company in the US is still struggling between cost pressures and competition.

Tesla said operating expenses increased by 50% in the quarter, mainly due to artificial intelligence (AI) projects and new research and development (R&D) programs. Although details were not disclosed, this investment is believed to be related to the Full Self Driving (FSD) self-driving system and the Optimus humanoid robot – two pieces that Elon Musk has repeatedly declared as the future of Tesla.

The reality, however, is less glamorous than the promise. Only 12% of Tesla’s fleet currently has FSD Supervised customers, and the company has yet to make significant progress toward bringing fully autonomous vehicles to market.

Revenue from the automotive segment reached 21.2 billion USD, up slightly by 6% compared to the same period in 2024. But revenue from environmental credits (regulatory credits) – an important source of “soft” revenue – decreased by 44%, to 417 million USD.

The underlying cause lies in the global electric vehicle price cut race initiated by Tesla, which has significantly narrowed profit margins. The loss of EV tax incentives in the US after President Donald Trump’s new spending bill took effect has further destabilized the market – consumers rushed to buy cars before the policy expired, creating a short-term but unsustainable sales boost.

In Europe, Tesla is facing a sales slump, partly due to the backlash against Elon Musk, who has been controversial for his political statements and social activities on X (formerly Twitter). Competition from rivals such as Volkswagen and BYD has also eroded Tesla’s market share.

Still, Tesla’s stock is up nearly 9% year-to-date, reflecting investor expectations that the company can overcome its earnings slump and resume growth. But that’s still lower than the major indexes and its large-cap tech peers.

While investors wait for clearer direction, Elon Musk continues to paint new scenarios. Tesla said it will start mass production of the Cybercab, the Semi electric truck and the Megapack 3 energy storage system in 2026.

.jpg)

Musk revealed that the Robotaxi service in Austin is expanding, and expects to eliminate safety drivers this year, aiming to deploy in 8–10 major cities by the end of 2025.

Meanwhile, Tesla is building its first production line for the humanoid robot Optimus, with the Optimus V3 expected to launch in the first quarter of 2026. Although Musk considers this to be “the most important product of the future,” the market remains cautious about a vision that still has many risks.

The renewable energy and storage business continued to be an impressive growth driver, with revenue rising 44% to $3.42 billion – a quarter of Tesla’s total revenue. Products like the Megapack and solar power systems are increasingly being used in data centers and large energy infrastructure.

Notably, xAI – Musk’s AI company – is one of the major customers, spending nearly $200 million on Tesla energy products in 2024–2025.

News

Inspired by David Beckham’s $1 billion win, Harry Styles decided to sue counterfeiters.

Harry Styles launches lawsuit inspired by David Beckham’s $1billion victory One Direction singer Harry Styles files case against counterfeiters One…

Charley Hull has opened up for the first time about her painful divorce from her ex-husband, MMA fighter John “Ozzie” Smith.

Charley Hull Opens Up on Traumatic Divorce from Ex-Husband for the First Time Ever At just 23, Charley Hull surprised many when…

Firerose recently shared a video exposing Billy Ray Cyrus’s ‘crimes’ in their relationship – and that video was anything but cute.

Country singer’s ex-wife alleges abuse in scathing video: ‘Control, isolation, rage, manipulation’ NASHVILLE, TENNESSEE – AUGUST 23: (L-R) FIREROSE and…

Billy Ray Cyrus demands thousands from woman claiming to be Miley Cyrus’ biological mom after she files bombshell lawsuit

The star had previously been on the receiving end of an unusual lawsuit relating to Miley Cyrus Billy Ray Cyrus…

“Not Walking Down the Aisle,” Riley Green and Ella Langley Join Country Music’s Elite Club.

Riley Green and Ella Langley Joins the Ranks of a Country Music Power Couple in the Record Books In June…

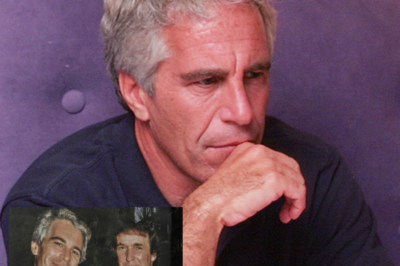

The Democratic Party released new photos of pedophile billionaire Epstein: Including President Trump and former President Clinton.

The Democratic Party releases new photos of pedophile billionaire Epstein. Democratic lawmakers have released new documents about pedophile billionaire Epstein,…

End of content

No more pages to load